New York State Income Tax Brackets 2025 India. Don't forget, the deadline for filing your 2025 state income tax returns is april 15, 2025. — osc has updated payserv with the new federal withholding rates for 2025.

Don’t forget, the deadline for filing your 2025 state income tax returns is april 15, 2025. — new york state has a progressive income tax system, which means that the more income you earn, the higher your tax rate.

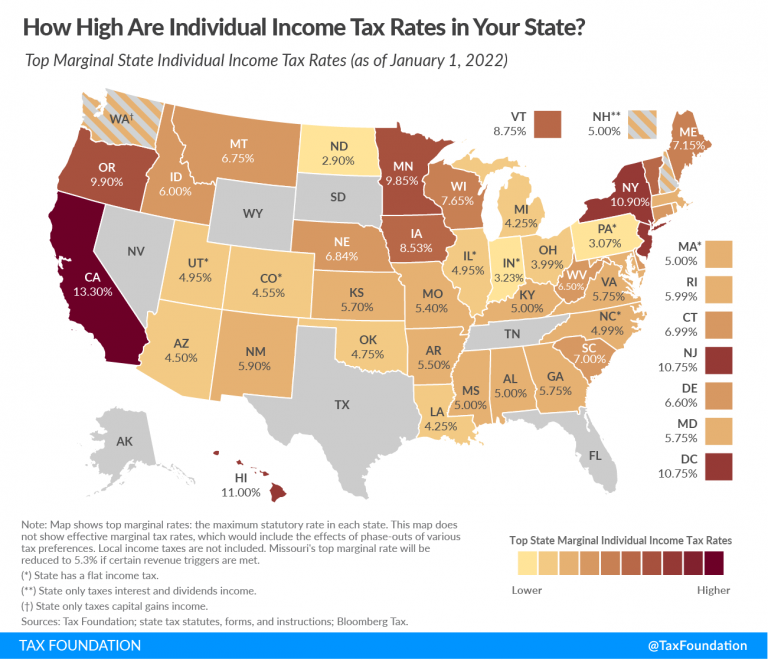

Compare 2025 Tax Brackets With Previous Years Mela Stormi, — new york state offers a range of income tax rates, including 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3%, and 10.9%.

Tax Brackets 2025 India Lulu Sisely, — the irs on thursday announced higher federal income tax brackets and standard deductions for 2025.

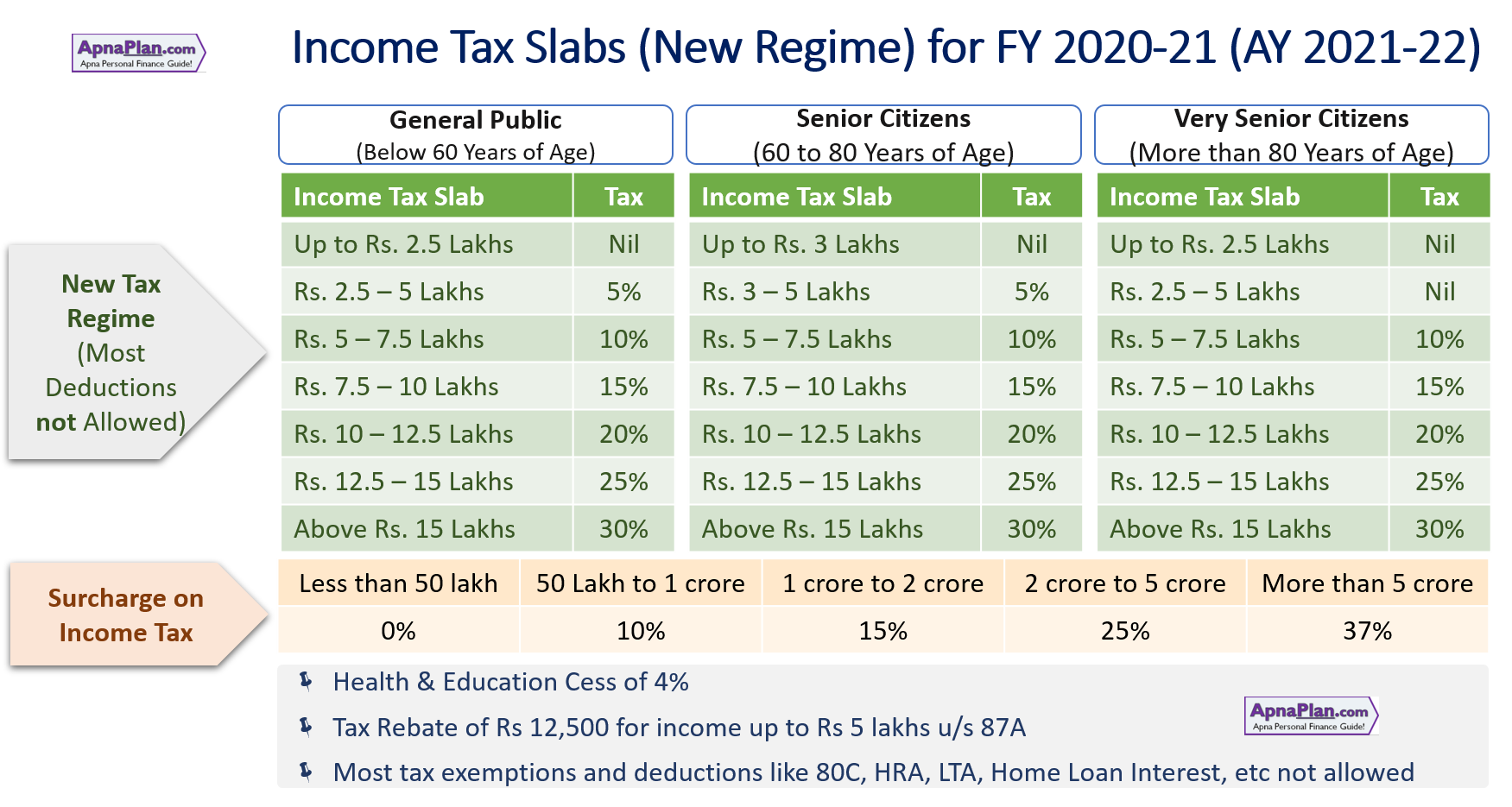

New York State Withholding Tax Tables 2025 Tomi Keriann, — taxpayers can now choose to pay income tax at lower rates under the new tax regime slabs on the condition that they withdraw from being considered for specific exemptions and deductions.

Ny State Tax Bracket 2025 Suzi Zonnya, To provide further tax relief to the salaried taxpayers while keeping the tax system simple, there is expectation that the government may increase the standard deduction from rs 50,000 to rs 75,000 under the new tax regime.

New York State Standard Deduction 2025 Jackie Cordelia, The tax tables below include the tax rates, thresholds and allowances included in the new york tax calculator 2025.

Tax Calculator 2025 India Fred Jenelle, If new jersey levies a higher marginal rate on our couples’ income, why is new york taking more tax?

Ny Tax Withholding 2025 daveta fleurette, Osc continues to use the percentage method on an annual payroll period for income tax withholding purposes.

Tax Brackets 2025 Calculator Leia Shauna, — taxpayers can now choose to pay income tax at lower rates under the new tax regime slabs on the condition that they withdraw from being considered for specific exemptions and deductions.

2025 Tax Rates And Brackets Single Shel Yolane, Altogether, there are seven federal income tax rates, which were established by the passage of the 2017 tax cuts and jobs act.

New tax brackets for 2025, By providing inputs with respect to income(s) earned and deductions claimed as per the act.