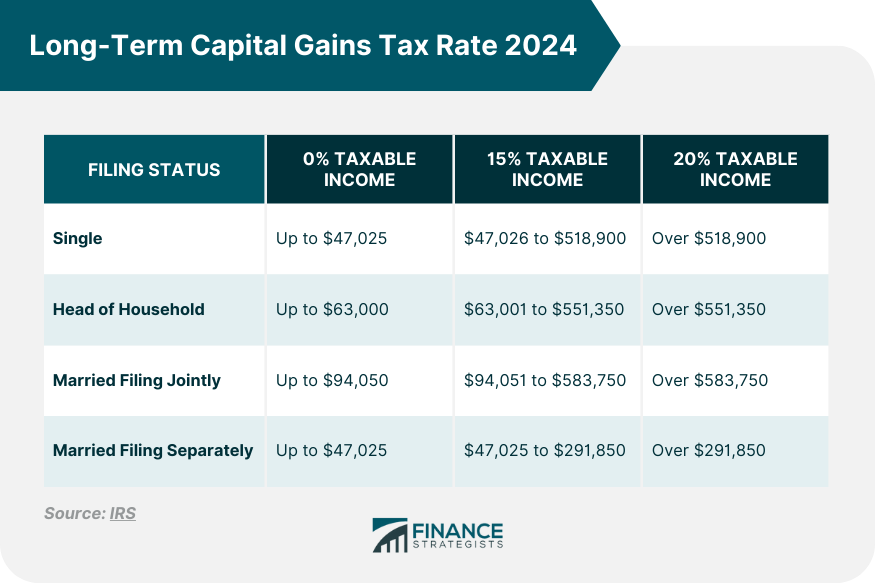

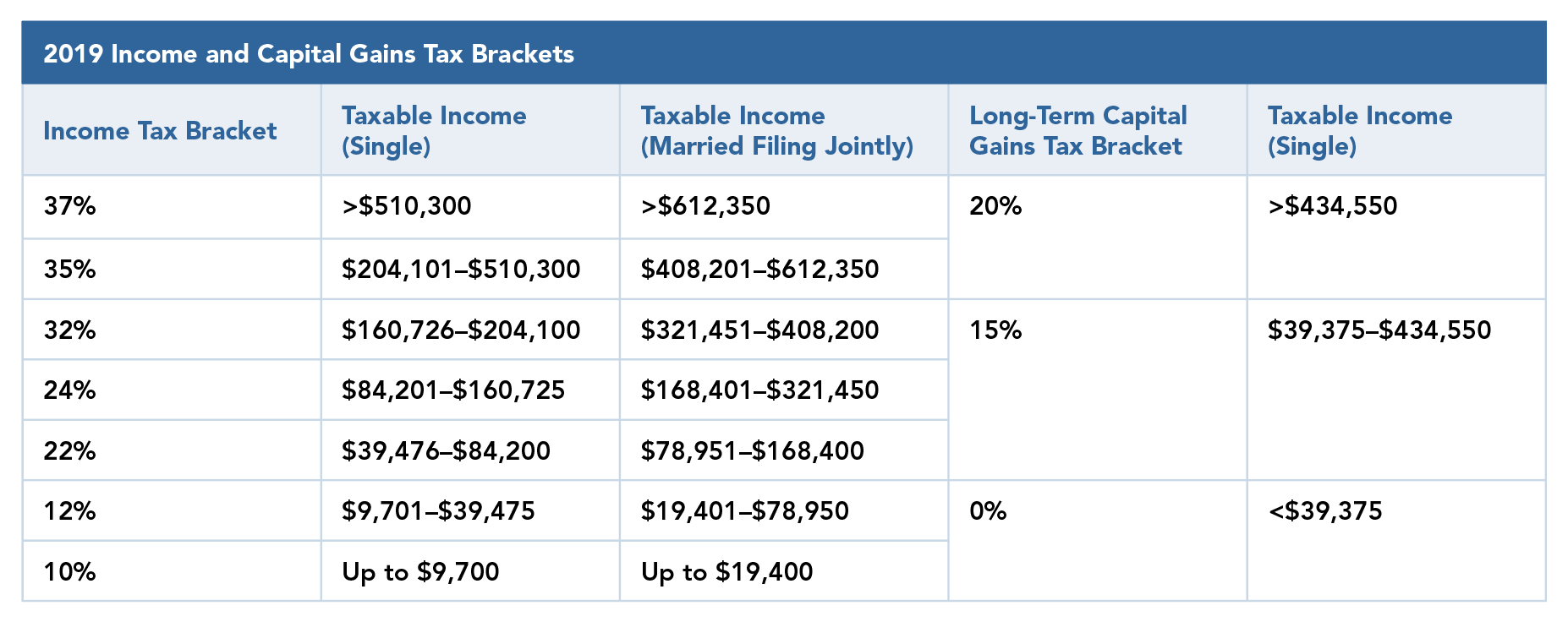

Capital Gains Tax Rate 2025 Stock Sale. In 2025, single filers making less than $47,026 in taxable income, joint filers making less than $94,051, and heads. Married couples filing jointly can get.

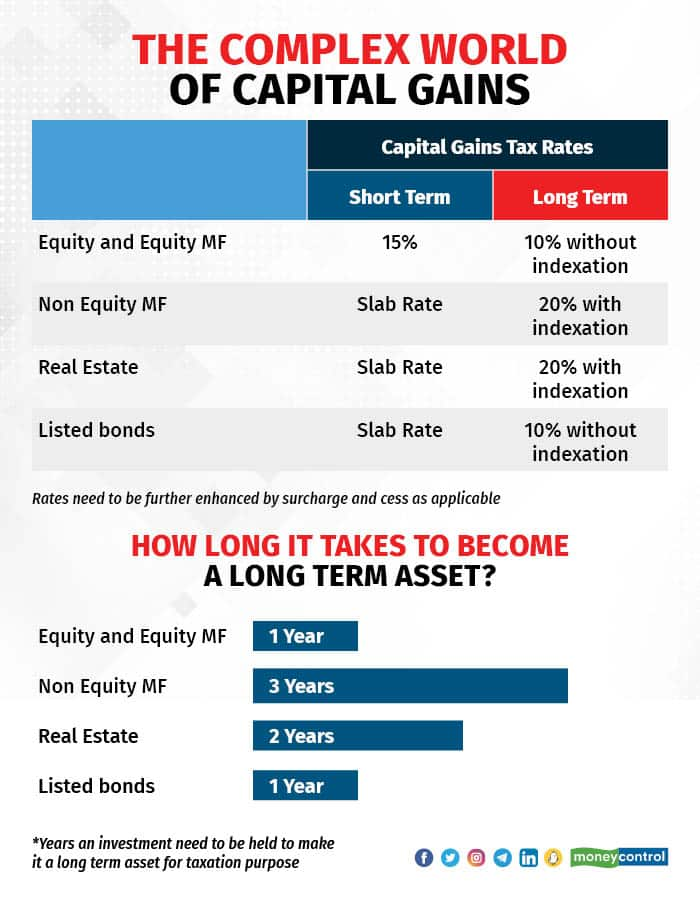

Married couples filing jointly can get the 0% rate if. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%.

Capital Gains Tax Rate 2025 Stock Sale Of Shares Fleur Jessika, Married couples filing jointly can get.

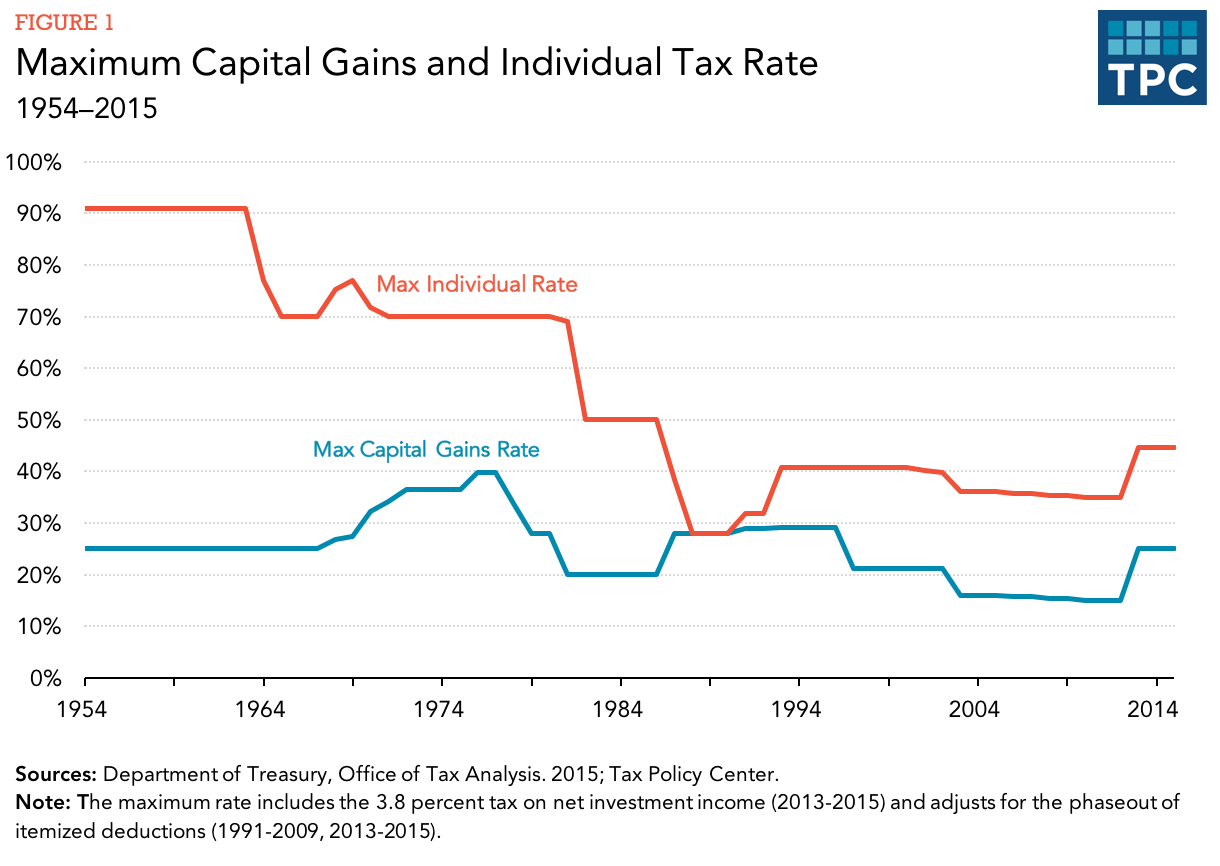

Capital Gains Tax Rate 2025 For Stock Tina Adeline, There are two main categories for capital gains:

Capital Gains Tax Rate 2025 Stock Sale Of Property Halie Karalee, 100% $0.6250 100% fund performance and distribution rate information as of 9/30/2025.

Capital Gains Tax Rate 2025 Overview and Calculation, How much capital gains tax will you pay?

Short Term Capital Gains Tax 2025 Stocks List Anna Maisey, That’s up from $44,625 this year.

Capital Gains On Stock Sales 2025 Berna Cecilia, 100% $0.6250 100% fund performance and distribution rate information as of 9/30/2025.

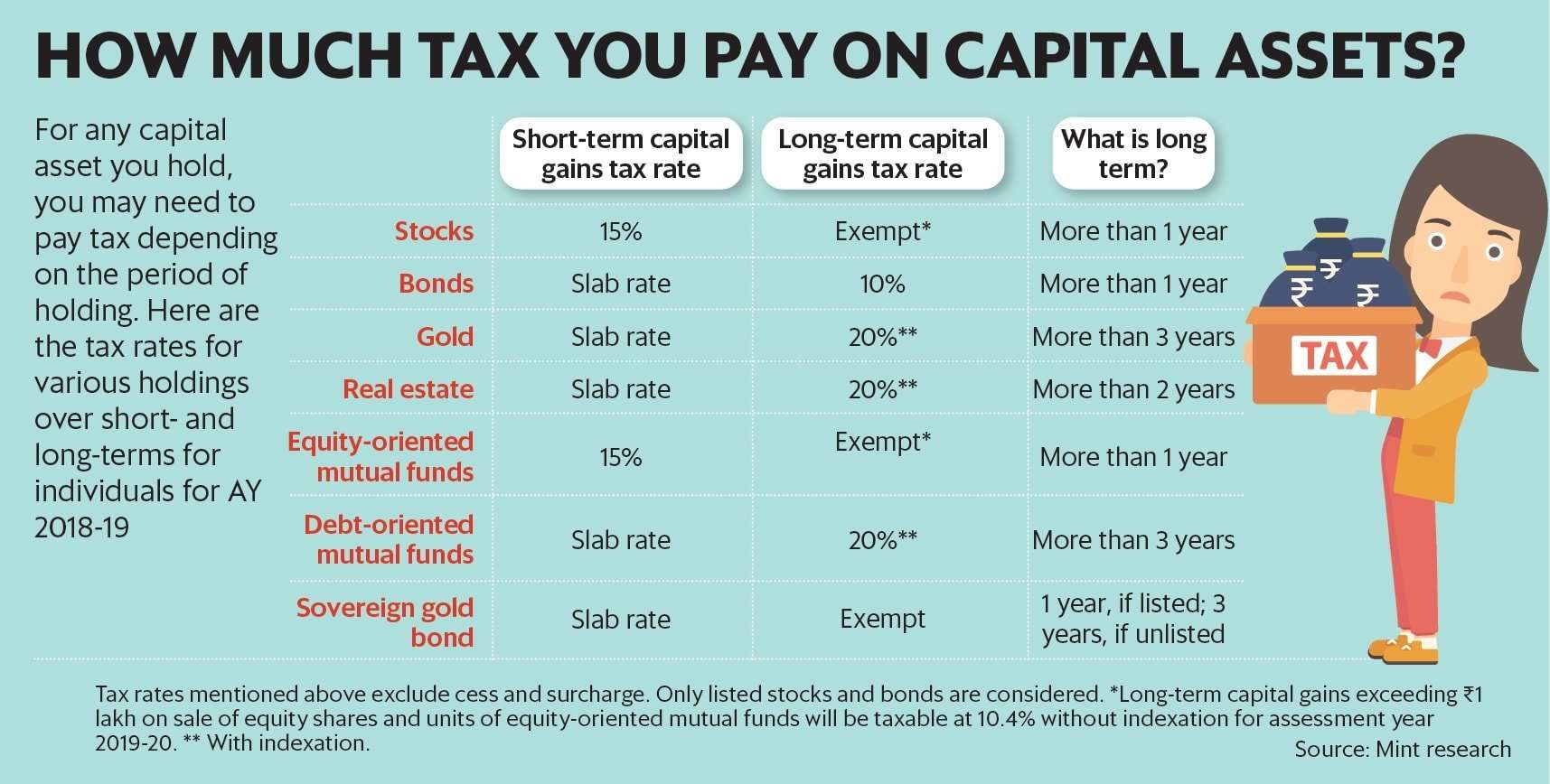

Capital Gains Tax Rate 2025 Uk Kiele Merissa, Capital gains arise on the sale or transfer of any capital asset, but the redemption of sgb by an individual with rbi is not treated as a transfer under section 47(vii) of the income.

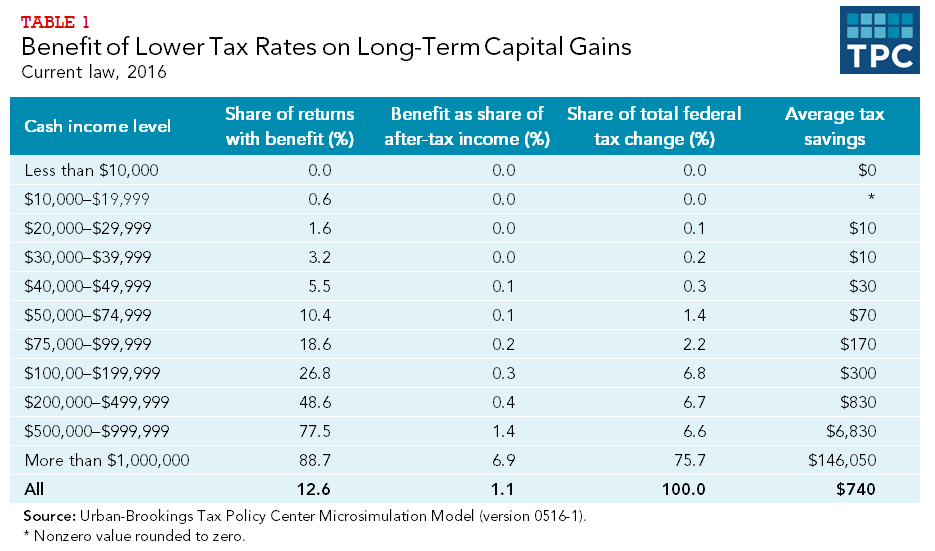

Capital Gains Tax Rate 2025/25 2024ora Hali Prisca, The higher your income, the more you will have to pay in capital gains taxes.